KARA’s members were nervous, and with good reason. They were minutes from opening the second act of 2011’s Kohaku Uta Gassen, Japan’s famous New Year’s Eve broadcast. Fighting off nerves before their interview, they missed a recording cue, performing their mic test live on camera. Though the members were embarrassed by the mistake, they pulled together to produce a high-quality Kohaku debut.

KARA’s members were nervous, and with good reason. They were minutes from opening the second act of 2011’s Kohaku Uta Gassen, Japan’s famous New Year’s Eve broadcast. Fighting off nerves before their interview, they missed a recording cue, performing their mic test live on camera. Though the members were embarrassed by the mistake, they pulled together to produce a high-quality Kohaku debut.

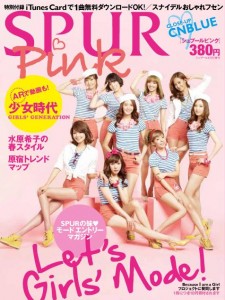

The ratings for their performance, a medley of their greatest Japanese hits including “Mister” and “Jet Coaster Love” reached 38.4%, trailing Japanese megastars AKB48 by only a tiny margin. Other K-pop groups performing at the event fared even better. SNSD’s debut got ratings of 39.9%, the highest of any girl group, and DBSK pulled in an astounding 42.6% in their third performance on the show. K-pop and J-pop fans alike are thus shocked that this year none of these groups have been invited to return.

Kohaku Uta Gassen, literally Red and White Song Battle, was first broadcast in 1951 as a radio show. Since then it has become the most-viewed annual show in Japan, lasting over 4 hours and including performances by more than 50 groups. Though the theme differs every year, the format is always male performers (white) vs female performers (red), with a winner declared at the show’s conclusion. In addition to cross-demographic exposure to 11.5 million viewers, appearing on Kohaku comes with the cultural prestige of having ‘made it’ in Japan. Though ethnically Japanese artists predominate, Kohaku has a long history of incorporating foreign acts, from Cyndi Lauper in 1990 to China’s Twelve Girls Band in 2003. South Korean artists have been historically well-represented. BoA and Seoul-born enki artist Kye Eun-Sook share the record for most continuous Kohaku performances by a non-Japanese native with six appearances each.

However, a lot has changed since BoA’s last Kohaku appearance in 2007. The Japanese market has been inundated with a second hallyu wave, producing many Korean superstars in Japan despite growing reactionary tension. Hallyu performers differ from most foreign artists in their acculturation to the Japanese market, through appearing in Japanese commercials, releasing singles in Japanese, and doing extensive PR campaigns abroad. This strategy, known as glocalization, involves reaching global markets by adapting a brand to the particular advertising milieu of each locality. The technique both originated in Japan (as dochakuka in the 1980s) and is considered particularly crucial for foreigners reaching the Japanese market.

One common way of glocalization in Japan involves releasing singles associated with large ad campaigns. In 2011, KARA did this in an ad for PALTY, a Japanese hair product, which featured clips of hits like “Lupin.” A pinnacle of their Japanese acculturation came with their Christmas advertisements for FamilyMart Fried Chicken. Thanks to an aggressive 1970s campaign by US fast food restaurant Kentucky Fried Chicken, fried chicken is synonymous with Christmas dinner in Japan, and KARA’s participation in the commercial demonstrated both the group’s understanding of Japanese traditions, and Japan’s acceptance of the group as purveyors of the a brand.

Amidst this success, however, was growing animosity towards Korean performers abroad. Kim Tae-Hee, a Korean drama actress, was subject to harsh criticism and eventually loss of Japanese sponsorship when details of her past political activities were discovered. When T-ara’s Jiyeon participation in a Japanese ramen commercial resulted in her eating noodles the Korean way, she was called “barbaric” and “uncivilized”. 2NE1’s music video for “Hate You” also received backlash, because of the use of nuclear reactors in a music video so soon after the Fukushima catastrophe. Even “Gangnam Style’s” success in other countries has been cause for criticism in Japan. A television representative dismissed the idea of giving PSY screentime, claiming “…the reason K-pop became so popular in Japan in the first place is because Korean artists are known for being beautiful, so PSY looked completely out of place on screen.” Many people have pointed to the recent renewal of territorial dispute surrounding the 1/14 of a square mile island called alternatively Dokdo, Takeshima, or for political neutrality the Liancourt Rocks. As this post did a great job explaining, in recent months there has a been a renewal of hostility with Korean President Lee Myung-Bak’s August 2012 visit to the islands and Park Jong-woo’s display of a controversial sign in the aftermath of Korea’s successful bronze medal football match against Japan. While reactions have been mixed, most have heralded this proclamation as the beginning of the end of hallyu in Japan.

Last Monday, Japanese press galvanized these fears by confirming rumours that no K-pop artists will participate in 2012’s Kohaku. Amidst complaints of politics encroaching into art, broadcast network NHK quickly issued a statement denying any relationship between growing political tensions and artist selection. Instead network executives claimed that hallyu performers did not have the 2012 Japanese sales record to justify a repeat appearance. However, this explanation comes in sharp contrast to the September 6th press conference statement by NHK president Masayuki Matsumoto. Speaking to the recent tension surrounding Dokdo, he explained “Lee Myung-Bak demanding apologies from the His Majesty the Emperor, as well as the Takeshima problem has created concern over whether Korean artists will be invited to perform, due to growing animosity from viewers.”

The sales records, though mixed, show little to support NHK’s most recent claim. While the 2012 Japanese sales of hallyu performers are less stable than 2011’s runaway success, K-pop stars still frequently sit atop Japan’s weekly Oricon charts and out-compete well-established J-pop groups. KARA’s double A-side release “Speed Up/ Girl’s Power” sold just shy of 160,000 copies in March, and sales from DBSK’s July 2012 single “Android” exceeded 175,000 copies. KARA’s re-release of their album “Super Girl” sold over a quarter of a million copies, claiming the 7th spot on Oricon’s album rankings for the first half of 2012. Though close, KARA’s 2012 sales record will likely top Momoiro Clover Z’s, a Japanese girl group that was invited to Kohaku. Still, when compared to previous releases, Korean groups have recently suffered significant and worrying declines. SNSD’s first week sales for FLOWER POWER (released 11/21) were 29,065, 12,000 down from “Paparazzi’s” first week. Similarly, KARA’s last single “Electric Boy” sold only ~ 75,000 copies, 50,000 less than their previous lowest selling single. DBSK, while still achieving sales records enviable for most J-Pop groups, have been unable their 2009-2011 sales record where every single sold over 200k.<

It’s unlikely that sales record alone can explain  K-pop’s absence in this year’s Kohaku. However, it’s equally unlikely that a simplistic explanation directly linking K-pop and Dokdo accounts for the complexities of Japan’s music industry and geopolitical ambitions. Importantly, though web reactions have focused on K-pop representation, this year’s Kohaku contains no performances by any non-Japanese artist. Although less common, 10 of the past 30 Kohakus, as recently as 2010, have had no foreign artists. Rather than particular ire towards K-pop artists, Kohaku’s performer selection is indicative of overall strategies employed by the Japanese entertainment market. Japan’s music industry is becoming increasingly unstable, and the nation’s reaction to these changing dynamics have been, as always, to look inward.

K-pop’s absence in this year’s Kohaku. However, it’s equally unlikely that a simplistic explanation directly linking K-pop and Dokdo accounts for the complexities of Japan’s music industry and geopolitical ambitions. Importantly, though web reactions have focused on K-pop representation, this year’s Kohaku contains no performances by any non-Japanese artist. Although less common, 10 of the past 30 Kohakus, as recently as 2010, have had no foreign artists. Rather than particular ire towards K-pop artists, Kohaku’s performer selection is indicative of overall strategies employed by the Japanese entertainment market. Japan’s music industry is becoming increasingly unstable, and the nation’s reaction to these changing dynamics have been, as always, to look inward.

Despite worldwide reputation for being technologically advanced, Japan has been exceeding slow to adapt to the digital revolution, a pace that has seen the country’s music industry struggling in recent years. Japan did not release DRM-free digital media until earlier this year, and has been slow to license music for streaming and downloading services like iTunes. Sales of mobile-optimized media, including ringtones and cell-phone quality music videos, have recently fallen from a predominant source of revenue to having minimal market impact. While the first half of the year saw a 23% increase in digital music sales, third quarter reports show a sharp decline, as new draconian laws on illegal file sharing come into effect. As of October 1, 2012, downloaders can receive up to 2 years in prison or $25,000 in fines. Punishments for uploaders are five times as harsh. Though these provisions were intended to stimulate demand for legal music, the earliest results suggest the laws have instead proven detrimental for the music industry. Japanese consumers have become accustomed to sampling songs before purchase and now feel less comfortable buying albums based on singles or advertisements. Sampling is particularly crucial for less-established groups, where buyers are unlikely to make purchases based on reputation. Thus the laws have been particularly harmful for debuting and foreign artists trying to stake a hold in the Japanese music industry.

The only good news for the Japanese music business comes from physical album sales, which have risen an unprecedented 11% in 2012. This makes Japan the only nation in the world where physical sales are growing while digital sales decline. However, this is doubly problematic for Korean performers. Though large online sites exist to order physical media, the vast majority of regular purchases still occur at local stores. There retailers have more control over which groups to feature, or even carry, making it more difficult for K-pop groups to gain national market penetration. More importantly, the fundamental force driving physical albums’ sales are the perks often contained within the packaging. From codes to vote in AKB48’s yearly senbatsu election (a televised popularity contest for members of the sprawling company) to signed posters, tickets to meet-and-greets, and raffles for live events, agencies provide incentives to buy multiple physical copies of every album a group releases. For Korean groups to compete in the physical media market, they have to both establish personal connections between fans and individual members, and commit to doing long promotions. Such an extensive PR campaign is difficult for artists that simultaneously produce singles for Korean, Japanese, and American markets. Though unintentional, recent developments in the Japanese music market are injurious to the performance of Korean groups in Japan.

More worrying, however, is how these measures show desperate attempt by the Japanese music industry to resist inevitable change, and reveal an underlying instability of the Japanese market long term. While Japan once had a population large enough to sustain a predominately domestic music industry, its population is rapidly aging. This past decade has also brought shifts in the music industry that have lowered expected profit margins, including the rise of digital content, the prevalence of illegal downloading, and the shift from album-based music to single-based music. Instead of trying to adapt to these changes, Japan’s music industry’s reactions have largely focused on keeping their profit margins stable.

More worrying, however, is how these measures show desperate attempt by the Japanese music industry to resist inevitable change, and reveal an underlying instability of the Japanese market long term. While Japan once had a population large enough to sustain a predominately domestic music industry, its population is rapidly aging. This past decade has also brought shifts in the music industry that have lowered expected profit margins, including the rise of digital content, the prevalence of illegal downloading, and the shift from album-based music to single-based music. Instead of trying to adapt to these changes, Japan’s music industry’s reactions have largely focused on keeping their profit margins stable.

Of particular concern is the current idol boom, predominantly responsible for spurring the surge in physical media. Japan has had 4 periods in their popular music history where J-pop idols have predominated, spaced roughly once a decade. These idols are able to draw large demands for physical media with the aforementioned marketing campaigns. However, Japan is already seeing a decline in idol dominance from a mid-2010 high, and this potentially sets up an uncertain future as large entertainment companies lose a significant sources of income. While South Korea and even Western countries seek to find fan bases on a global market, Japan spends very little marketing their stars outside of their own country. Japan’s industry is currently surviving, even thriving, but the long term stability of the market can be easily called into question.

Music industry dynamics are a stereotypical microcosm of Japan’s recent foreign interactions. Manufacturing in Japan has shifted from the 3s (steel, semiconductors [TV] sets) that were once the nation’s stronghold, to producing highly specialized products, predominantly designed for luxury markets. Though some goods like Sharp’s iPhone screens will undoubtedly expand with the growing technological marketplace, it is worrying that the nation’s industries are consumed with production of goods that fluctuate in lagging economies. Furthermore, 2hile Japan has trade agreements in place with many nations, it has been reluctant to enter into Free Trade Agreements with global powers like the EU, China, and the US. While EU negotiations appear to be progressing slowly, Japan’s obvious absence from the Trans Pacific Partnership (currently in negotiation between China, the US, Australia and others) shows a reluctance to fully participated in a global market. This hesitancy has even been noticed by domestic companies, like Toshiba and Suzuki, who have shifted their manufacturing to foreign plants in Singapore, Taiwan and South Korea, all countries with more favorable trade agreements.

Korea has been a particular target of outsider wariness because of the nations’ rocky political history, shared cultural traditions, and growing competitive edge in once Japanese-dominant markets. In electronics, Korean company Samsung has become a major competitor to Sony, leaving the once-dominant Japanese giant struggling to maintain a foothold even in its own country. Automobile manufacturer Hyundai is becoming a global competitor with Toyota, having already overwhelmed Mitsubishi and Suzuki, and is expected to overtake the Japanese company in European markets within the next two years. Ultimately, the Dokdo/Takeshima controversy is symptomatic, but not explanatory of the growing domestic tensions responsible for the Kohaku snub. Though it is nice to be able to point to one issue as being the cause of K-Pop’s struggles in Japan, in reality both Kohaku and Dokdo reflect Japan’s unsure footing in the rugged geopolitical landscape shared by the two nations.

Given the growing political  and cultural tensions, many K-pop fans may be glad to see Japan’s entertainment industry struggling. However, the fate of the Japanese music industry is critical to the continuing success of K-pop. In May 2012, a Japanese researcher reported that up to 80.8% of all K-pop’s profits were coming from Japan. Although this figure has been greatly diminished with the success of “Gangnam Style,” a steady stream of income from Japan is crucial to the continued success of hallyu artists. Without this financial stability, Korean groups will be limited in scope to guaranteed hits. As fans, this means an over-reliance on the safe, often derivative singles known to appeal to K-Pop’s target markets, and potentially a shift away from the slew of artistic, progressive releases that have characterized 2012. Japan is critical to K-pop’s global success, and the coming problems from the Japanese music system are certainly cause for Korean music fans to worry.

and cultural tensions, many K-pop fans may be glad to see Japan’s entertainment industry struggling. However, the fate of the Japanese music industry is critical to the continuing success of K-pop. In May 2012, a Japanese researcher reported that up to 80.8% of all K-pop’s profits were coming from Japan. Although this figure has been greatly diminished with the success of “Gangnam Style,” a steady stream of income from Japan is crucial to the continued success of hallyu artists. Without this financial stability, Korean groups will be limited in scope to guaranteed hits. As fans, this means an over-reliance on the safe, often derivative singles known to appeal to K-Pop’s target markets, and potentially a shift away from the slew of artistic, progressive releases that have characterized 2012. Japan is critical to K-pop’s global success, and the coming problems from the Japanese music system are certainly cause for Korean music fans to worry.

In the short term, however, KARA are doing fine in Japan. While it might not be Kohaku, on January 6th they are performing their own New Year’s concert at the Tokyo Dome, Japan’s largest concert venue. They also have their own anime, KARA the Animation, scheduled for spring 2013. SNSD recently announced plans to focus on the Korean market, but will still hold a 6-city Japanese concert tour in 2013. Even without foreign performers, Kohaku will probably pull in big ratings in Japan. However, this is also the year NHK has decided to test the waters by expanding the show’s broadcast market to parts of California. The company may be disappointed in their international ratings, as they grow to understand K-pop’s hold on the global market.

(Sankeibiz.jp, theverge [1] [2], Kotaku, WSJ, Forbes [1] [2], Japan Today [1] [2], Omonatheydidn’t, Japan Magazine)